Political and geopolitical risks are piling up around the world; the trade war between the US and China, uncertainty on Brexit, tensions in the Strait of Hormuz, protests in Hong Kong ...

As a result, uncertainty is spreading in equity markets, but if you seek a safe haven in the bond markets, you need not pin any great hopes on achieving a decent return – yields on the most secure European government bonds are negative.

However, you do not necessarily have to sell out of equities to shave the top off your risk. Instead, you can ensure you have the right equities in your portfolio, according to Danske Bank’s investment strategist, Lars Skovgaard Andersen.

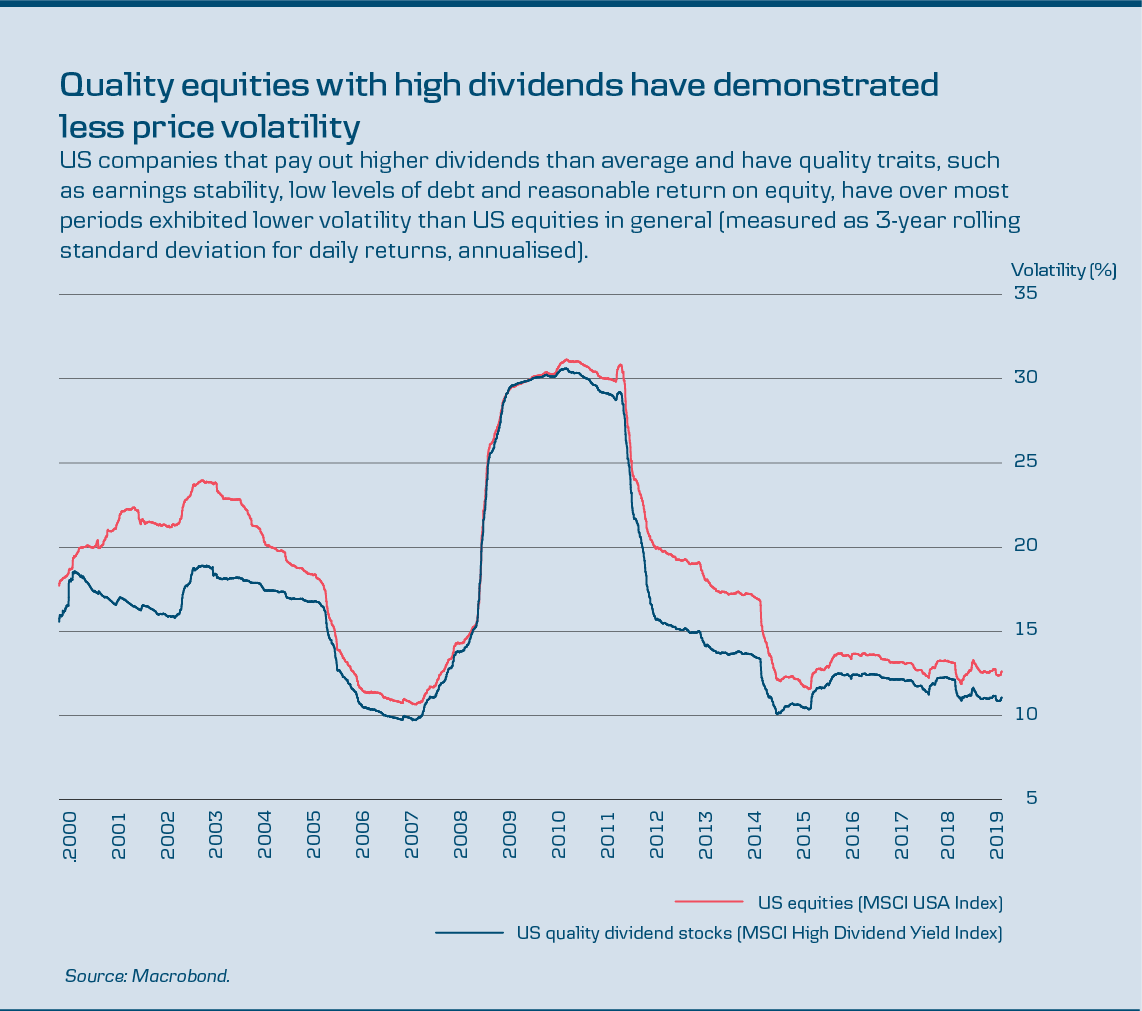

“At Danske Bank, we currently have a lot of focus on quality equities that regularly pay high dividends to investors. Quality equities are companies with particular characteristics, such as stable earnings and modest debt, and we can see that quality equities with high dividend payments have historically exhibited lower volatility than the equity market in general (see graph below). We expect this will also be the case going forward,” he says.

But if quality equities with high dividends carry a lower risk than the equity market in general, is the expected return then not lower too?

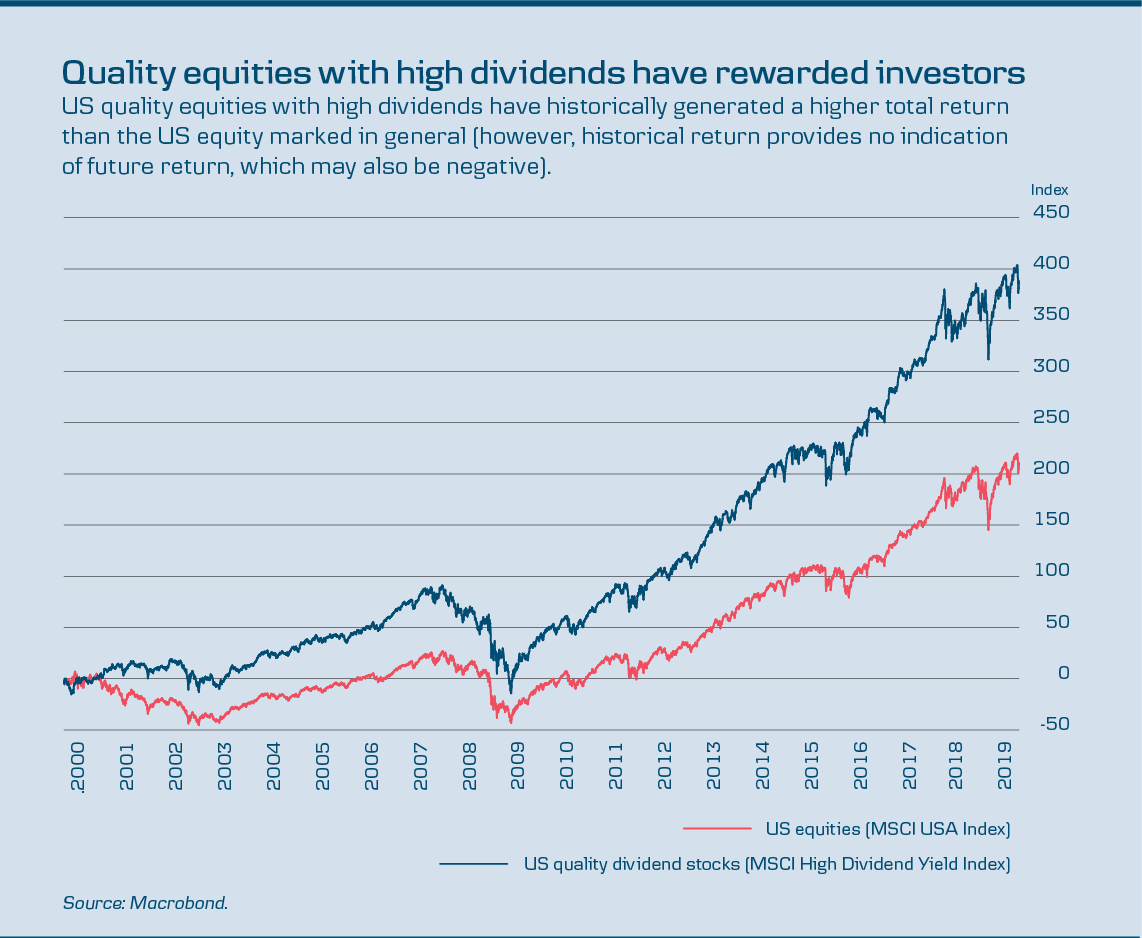

“As a rule of thumb, it’s correct that return and risk are positively correlated in the financial markets – though that has in fact not been the case here. In recent decades, quality equities with high dividends have not only exhibited lower price volatility than the equity market generally, but have also generated a higher return (see graph below). Hence, investors have had the best of both worlds here. Naturally, there is no guarantee this will also be the case in the future, but right now high quality, high dividend equities are the ideal equities for these uncertain times, in our view,” says Lars Skovgaard Andersen.

Why have quality equities with high dividends been less volatile than the equity market in general?

“The short answer is that these companies generally have sensible and predictable earnings, and offer investors a relatively stable income via their regular dividend payments. These are popular characteristics for many investors and they impart a certain robustness to these equities, so they are often punished less harshly in periods of equity market decline. “On the other hand, this type of equity often lags a little when markets rise strongly, which we might potentially see if, for example, the US and China suddenly find a long-lasting solution to the trade war – though we don’t expect this to happen any time soon. In addition, many investors have recently placed money in these equities, which could result in them dipping if the uncertainty in global markets eases and a lot of investors sell off here in order to move into other equity types.

“That being said, our view is that investors should always have a certain proportion of this type of equity in their portfolio as ballast to help keep the ship stable.”

What significance does the low level of interest rates have for dividend equities?

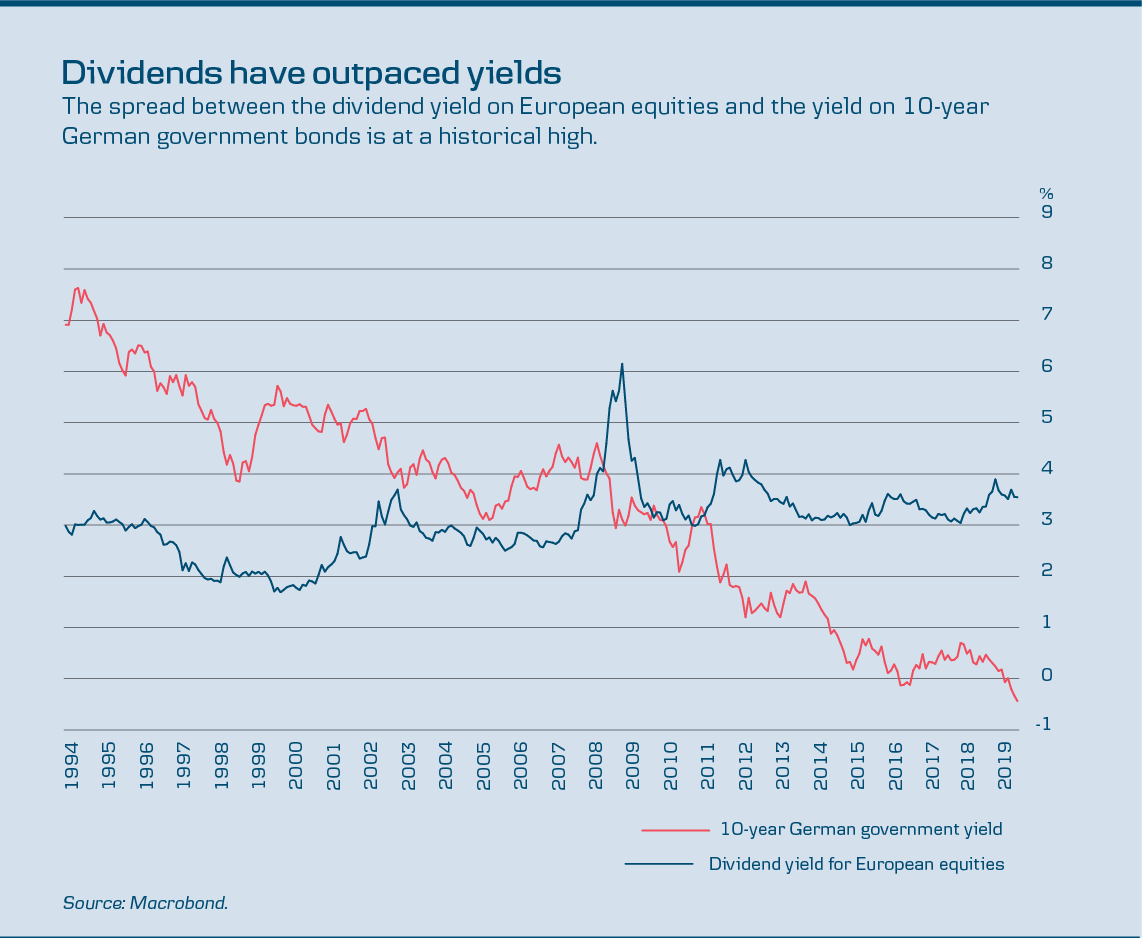

“Falling yields have made bonds less attractive for investors focused on investments that provide a regular income, and this makes dividend stocks a relatively more attractive alternative. Hence, we could say that central banks are also providing a tailwind for dividend stocks with their accommodative monetary policy stances – and we expect further easing in the coming years. “In fact, the difference between the yield on a 10-year German government bond and the dividend yield on European equities has never been more in favour of equities (see graph below). Earlier, through the 1990s and up to the financial crisis in 2008, investors could get a higher interest income from government bonds than the dividend yield from equities, but after many years of falling interest rates this has been turned around.”

Should investors go for equities with the highest dividends?

“No, you should not blindly accept high dividends. While they can be a tempting indicator right now, they are no guarantee that a company’s long-term business model is healthy and sustainable. That is why we focus on companies with solid business models and competent management, so we can also expect attractive dividend payments in the future.”

.jpg?rev=6bd88697d04b4d6c99d55712e497aa1f&hash=4E68B1FCED54281E79FE2BBC1D0D5D9B)

How the portfolio manager selects attractive dividend stocks

Peter Nielsen is chief portfolio manager for Danske Invest Europe High Dividend, which Morningstar has five times in the past 11 years named Denmark’s best fund in European large-cap equities. The fund invests in European companies that pay high dividends to investors.

How do you put together the portfolio of dividend stocks

“We have a robust base of around 20 defensive equities that have proven to be relatively stable. These are quality companies that could well be viewed as a little boring, but for us what is more important is that the majority of companies in our portfolio are capable of delivering solid results year after year, rather than suddenly surprising the market with news that causes the share price to soar – or, alternatively, crash to Earth.

“In addition, we have 10-15 more opportunistic equities that we estimate hold a greater potential to beat the market during the good times,” explains Peter Nielsen.

How do you select individual equities?

“Our investment universe comprises the 800 largest equities in Europe. Of them, there are around 320 relevant companies, who are ranked according to a combination of high dividend payouts, attractive price valuations and return on equity. We select around 35 companies based on these measures who, in our view, have the potential to deliver the best risk-adjusted return. “We draw on an extensive analysis apparatus and a team of nine portfolio managers and analysts, who have all specialised in particular areas within European equities. We also visit all the companies regularly and have a very good insight into how they are developing.”

What is the dividend yield of the companies in the portfolio?

“At the moment, the companies are paying out an average of 5% in dividends per year. Europe is traditionally the region that offers the highest dividends, companies in the US, for example, have more focus on using their profits to buy back equities or making investments in growth.”

Danske Bank has prepared this material for information purposes only, and it does not constitute investment advice. Always speak to an advisor if you are considering making an investment based on this material to establish whether a particular investment suits your investment profile, including your risk appetite, investment horizon and ability to absorb a loss.