When Søren Mørch took over as Chief Portfolio Manager of our emerging markets debt hard currency strategy last year, his task was simple – but challenging: to continue to employ and further improve an already well-performing strategy.

So far, Søren Mørch and his team have done an excellent job.

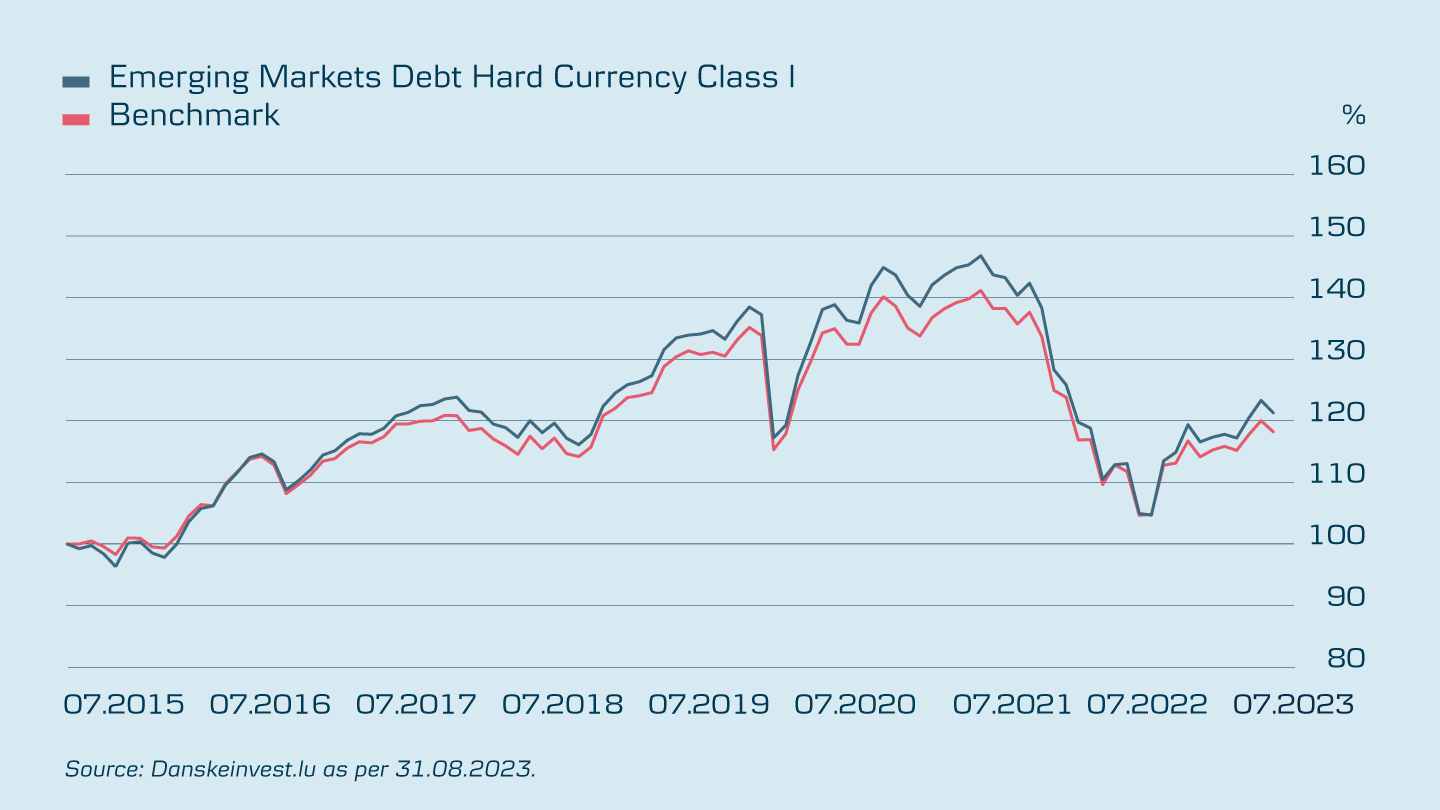

Since the beginning of November 2022, when Søren Mørch joined us, the strategy has outperformed its benchmark by 3.09% (as of 31.08.2023). According to the most recent data from eVestment, the strategy is among the best performing EMD HC strategies worldwide in 2023.

So, what have Søren Mørch and his team changed?

“The strategy already had a solid foundation with a proven track record, and this foundation remains intact. However, we have added a more sophisticated credit rating model, which in our view enables us to make even better decisions in terms of country allocation. Machine learning has been key to this development,” he says.

We now use both models in tandem, as we see value in having two different perspectives. When the signals from both models align, we can be more confident about the result.Søren Mørch, Chief Portfolio Manager

An application of artificial intelligence

Machine learning is widely considered an application of artificial intelligence (see fact box). The aim with our machine learning model is to model credit risk better, thus improving our ability to identify emerging markets that are attractively priced.

Our model uses large amounts of data to sort countries into credit rating categories from AAA to D based on macroeconomic fundamentals, such as government debt, government interest payments, institutional strength, etc.

“The advantage of our new model is that it requires very little structure and very few assumptions compared to more traditional econometric models. Unique to the model is the algorithm that is free to explore a multitude of different relationships between variables – including some that we as humans would never think to consider – to tap into potentially better ways of making predictions. This could include higher order correlations between multiple variables, which can be almost impossible for a human to think through,” explains Senior Portfolio Manager Joshua Loud.

What is machine learning and how does it work?

• Machine learning is the process of using mathematical models of data to help a computer learn without direct instruction. It is considered a subset of artificial intelligence.• Machine learning uses algorithms to identify patterns within data, and those patterns are then used to create a data model that can make predictions.

• With increased data and experience, the results of machine learning are more accurate – much like how humans improve with more practice.

Source: Microsoft.com

Training the model with historical data

Investing in EMD HC is all about credit risk. How do we predict credit rating developments for various emerging markets within the next 1-2 years, and to what extent are these reflected in market pricing? These are key questions.

As former Head of Country Risk at the European Bank for Reconstruction and Development (EBRD), Joshua Loud has played a leading role in the implementation of the new credit rating model.

“Basically, there are thousands of different relationships we could consider, and the model explores all of them and presents us with the ones that work best. We train the model using historical data, then we input macroeconomic forecasts that enable the model to make predictions about credit risk,” he says.

Portfolio management then apply a qualitative adjustment process.

“For other, more cyclical events, such as upcoming political elections, we can adjust the model output to reflect additional information that the model cannot see,” adds Joshua Loud.

The value of two different perspectives

The portfolio team also still use our traditional econometric model, which has been the backbone of our EMD HC strategy for years. Like most traditional models, it is based on a lot more assumptions. For example, most traditional models assume that variables are related to one another linearly – e.g. if debt goes up by 10% of GDP, your credit risk score increases by 1 notch.

In contrast, the machine learning model requires no assumptions about linearity or any other forms of relationship. It might find that the impact of increasing debt on credit risk is different for countries with low debt burdens compared to those with high debt burdens, or that impact depends on the level of development.

“We now use both models in tandem, as we see value in having two different perspectives. When the signals from both models align, we can be more confident about the result, whereas if they send conflicting signals, we tend to be a bit more cautious or do some more exploring,” says Chief Portfolio Manager Søren Mørch.

El Salvador and Egypt prime examples

Søren Mørch would highlight El Salvador and Egypt as specific examples of the value of our new machine learning model.

“Both our models suggested El Salvador is a better credit risk than its current official rating, with our machine learning model being a tad more optimistic. This confirmed our positive view on El Salvador, and so far this year our overweight in El Salvador has made a positive contribution to our performance. In contrast, the models were more divided on Egypt, with the machine learning model more cautious than the econometric model. We have been more cautious on Egypt because of the divergence – and given that credit spreads are up in Egypt year-to-date, that caution seems to have been warranted,” he says.

Historical return

Return since inception of Danske Invest Emerging Markets Debt Hard Currency Class I. Past performance is not a reliable indicator of future results. Future returns may be negative.

DISCLAIMER: This publication has been prepared as marketing communication and does not constitute investment advice. Please note that historical return and forecasts on future developments are not an indication of future return, which can be negative. Always consult with professional advisors on legal, tax, financial and other matters that may be relevant for assessing the suitability and appropriateness of an investment. Please refer to the prospectuses and the key investor information before making any final investment decision. The prospectuses, the key investor information of the fund and information regarding complaints handling (investor rights) can be obtained in English here (under “Documents”). Danske Invest Management A/S may decide to terminate the arrangements made for the marketing of its funds. More information on the sustainability-aspects of the funds can be obtained here. The decision to invest in the funds should take into account all of the characteristics of the funds as described in the prospectuses.