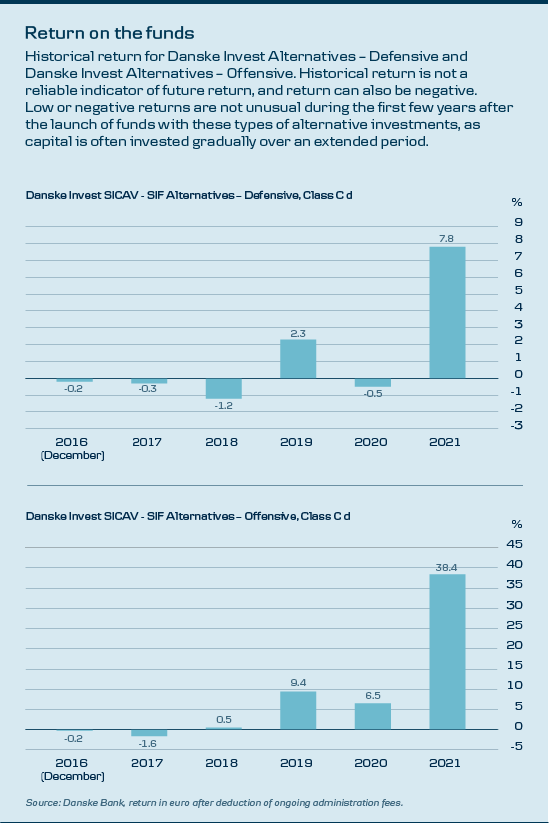

Last year, institutional investors in Danske Bank Asset Management were again given the opportunity to invest in the two funds Danske Invest SICAV-SIF Alternatives – Defensive and Danske Invest SICAV-SIF Alternatives – Offensive. The funds were reopened after being closed for new capital since their original launch in 2016 – and they can now look back on their best year ever:

- Danske Invest Alternatives – Defensive mainly invests in assets with a stable return profile in the areas of private credit, i.e. loans to companies, and infrastructure. Return here was 7.8% in 2021 after administration fees.

- Danske Invest Alternatives – Offensive takes on more risk in its quest to achieve a higher return. The fund mainly invests in assets with potential for capital gain in the areas of private equity, i.e. unlisted companies, and infrastructure. Return in 2021 amounted to 38.4% after administration fees.

However, it is important to remember that historical return is not a reliable indicator of future return and that return can also be negative.

We have intensified our focus on alternatives and are pleased to see it has paid off.Thomas Otbo,Return far above the norm

CIO at Danske Bank Asset Management

Thomas Otbo, CIO at Danske Bank Asset Management, characterises these returns as extremely satisfactory, but also extraordinary.

“Alternative investments are an important area for us, as they both encompass attractive investment opportunities and can also help diversify risk in a portfolio of investments. That is why we have intensified our focus on alternatives and are pleased to see it has paid off. However, investors cannot, of course, expect an annual return in the order of 38.4 per cent going forward – that is far above the norm,” says Thomas Otbo.

Where the funds have been focused

We have asked the chief portfolio managers of the funds to say a few words about developments in the past year:

“Given the fund’s defensive risk profile, the 2021 return of 7.8 per cent is at the upper end of what we expect going forward. Last year our focus was on improving return via intensified investment activity, among other things, with investments mainly concentrated in private credit supplemented with an infrastructure investment to optimise the return profile and reduce risk by increasing diversification," says Michael Bech, chief portfolio manager for Danske Invest Alternatives – Defensive.

“Return in 2021 was driven by private equity investments in particular. Over the year, our focus has been on optimising the opportunities for return and having a high level of investment activity, especially in the private equity sphere, though we have also made selected investments in infrastructure and private credit. We also for the first time undertook direct investments in individual companies through co-investments, where we invest alongside capital funds, which tends to involve lower costs compared to investing via private equity funds," says Jens Denkov, chief portfolio manager for Danske Invest Alternatives – Offensive.

Note that these funds are aimed at investors with a long investment horizon and that investing in alternatives involves certain risks. The most important single factor for the fund’s return in the longer term is whether the portfolio managers are able to select attractive investments for the funds’ portfolios. Investors should also be aware that opportunities to sell your shares in the funds may be limited during periods of significant turmoil and falling prices in the financial markets.

DISCLAIMER: This publication has been prepared as marketing communication and does not constitute investment advice.

Please note that historical return and forecasts on future developments are not an indication of future return, which can be negative. Always consult with professional advisors on legal, tax, financial and other matters that may be relevant for assessing the suitability and appropriateness of an investment. Please refer to the prospectus and the key investor information before making any final investment decision. The prospectus, the key investor information of the fund and information regarding complaints handling (investor rights) can be obtained in English here (under “Documents”):

Danske Invest Alternatives – Defensive

Danske Invest Alternatives – Offensive

Danske Invest Management A/S may decide to terminate the arrangements made for the marketing of its funds.