“How do you as a portfolio manager take sustainability into account when investing customer assets?” In answering this question, Danske Bank’s portfolio managers give their perspectives on e.g. corporate governance in the Russian market, influencing oil companies to embrace the low-carbon transition, property companies’ value chains, the importance of carbon emissions data, or investing in the transition towards a sustainable future.

In Danske Bank’s second annual report, Our Sustainable Investment Journey, we share such examples of how portfolio managers leverage our sustainable investment strategy – called ESG Inside – across asset classes and strategies, and we share our initiatives and progress on integrating sustainability into our investment business.

“As portfolio managers, we need to engage with companies in order to both understand complicated matters as well as influence and support them in the right direction.”Olga Karakozova, portfolio manager

ESG Inside is an integral element of Danske Bank’s ambition to embed sustainability in its core business. This publication shows how our investment teams work with ESG Inside their investment processes to deliver attractive returns and value to customers while influencing companies to integrate sustainability and create value for the wider society.

Expanded active ownership through voting

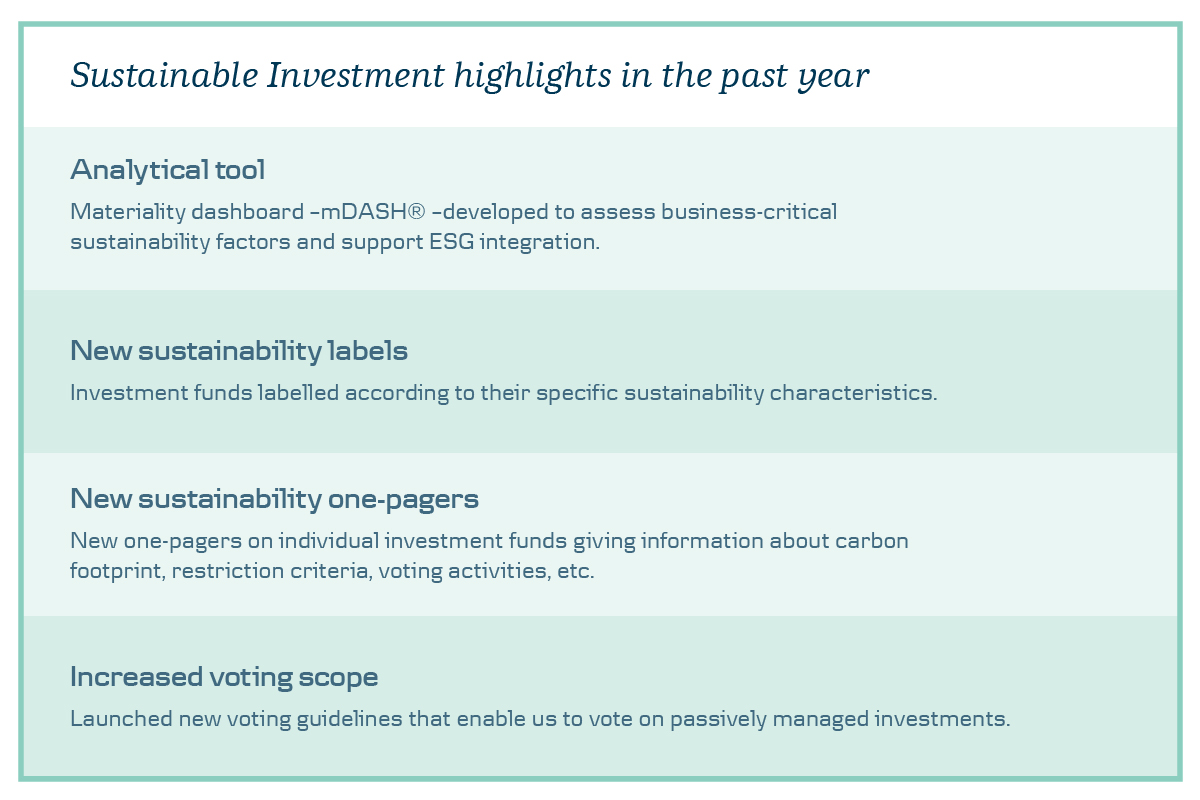

In the past year, we have also strengthened our ability to vote more extensively and have launched new voting guidelines. This initiative enables us to vote at the general meetings of companies in index funds, thereby increasing the number of companies that we can support and influence to address business-critical sustainability issues.

“Our new voting initiative provides us with a stronger foundation for actively contributing to companies becoming even better at focusing on long-term value creation that benefits both investors and society in general."Thomas Otbo, Head of Solutions and responsible for index products

Promoting material ESG data

High quality sustainability data is essential for our investment processes and ability to analyse material ESG business matters. Supporting the journey for better quality ESG data and corporate disclosure requires a collaborative effort by investors, companies and policymakers. In the publication, we present four priority areas to promote and support companies in their efforts to provide standardised ESG disclosures that are financially material, comparable, accessible and reliable.

mDASH® enabling a strong ESG integration

To enable our investment teams to take ownership of the ESG analysis and focus on financially material ESG matters, we have developed our own proprietary ESG tool called mDASH®. The tool is instrumental to our commitment to ESG Inside and is used by our investment teams to holistically assess and evaluate corporate sustainability performance. You can learn more about mDASH here.

“mDASH creates considerable value for us as portfolio managers, as we can separate out ESG factors with investment value from non-material ESG factors and at the same time cut through the noise from the agencies’ diverging analyses of the same company.”Kasper Brix-Andersen, Head of Fundamental Equities

Read Our Sustainable Investment Journey

Learn more about our progress on sustainable investment and read our portfolio managers’ stories in ‘Our Sustainable Investment Journey’ here.