Today, Danske Bank Asset Management releases its publication ‘Our Responsible Investment Journey’, detailing Danske Bank Asset Management’s work with responsible investments.

The demand for responsible and sustainable investment products has soared the past year. Danske Bank Asset Management currently offer 89 funds and sub-funds that promote environmental or social characteristics (article 8 as set out in SDFR).

“We have chosen a conservative approach to positioning our products, as we want to ensure that we live up to the extensive regulatory requirements and thus honour the spirit of SFDR,” says Christian Heiberg, Head of Danske Bank Asset Management.

He adds that he expects to be able to offer sustainable investment products (article 9) in the near future.

“We are fully focused on constantly improving our sustainability efforts to stay ahead of the curve and be one of the best Nordics banks for responsible investments. We will continue our focus on building robust sustainability processes, expanding ESG data and developing analytical tools and we plan to significantly expand our product offering in ESG and sustainable investments in the coming year,” says Christian Heiberg.

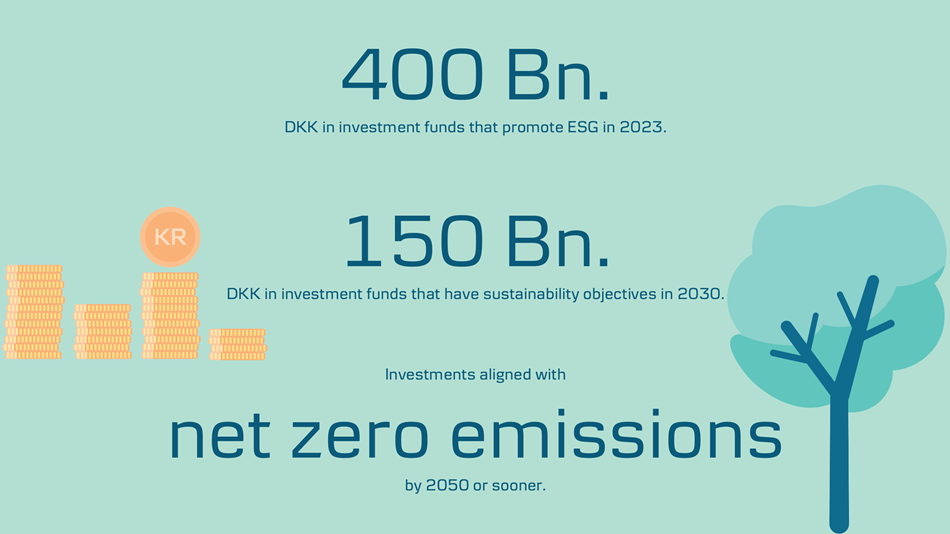

To ensure measurable efforts and progress, Danske Bank Asset Management has set new sustainability targets aligned to the SFDR regulation. They have also committed to supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner.

You can read more about the new targets on page 6 and on page 18 and in this article: Danske Bank raises the bar on sustainable investment targets to support green transition.

EU regulation revolutionized responsible investments

In March 2021, the EU Sustainable Finance Disclosure Regulation (SFDR) came into force, the first major regulation with the purpose of channelling more assets towards sustainable investments.

In line with the new regulation, Danske Bank Asset Management has categorised its products.

Read more about the labelling of funds on page 48 in the report

Active ownership: Social issues in focus

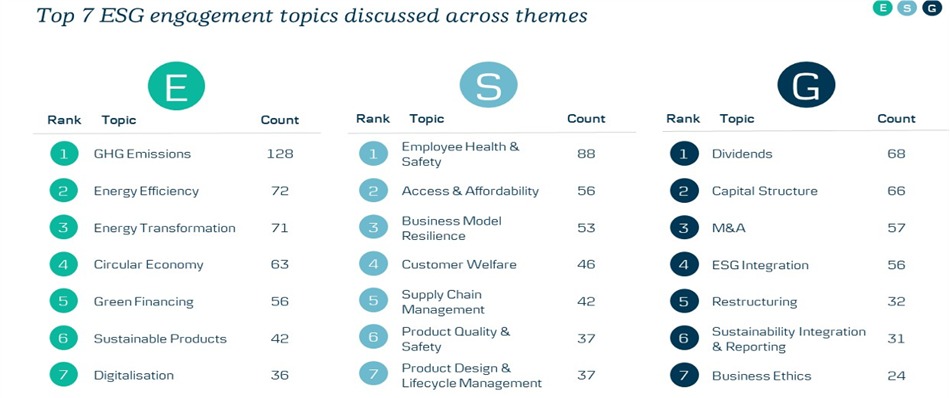

Looking into the investments in Danske Bank Asset Management, COVID-19 had a great impact. During the pandemic, there has been an increasing attention to social issues as Employee health and safety was the second most common ESG topic for Danske Bank’s portfolio managers to engage with companies on in 2020. The climate agenda was the topic most often discussed with the companies.

“While environmental and governance issues have been high on the ESG agenda for many years, the outbreak of COVID-19 marked a new era for the social issues. With COVID-19, social issues have become a hot topic in many company engagements. It has prompted us to focus on how companies ensured the health and safety of their employees as part of protecting their business and slowing the spread of the virus,” says Erik Eliasson, Head of Responsible Investment at Danske Bank Asset Management.

In the report (page 22), you can read about how Adidas ended up in a media storm due to social issues.

In addition to engagements, the Danske Bank Asset Management voted more than 5,200 times at general meetings during 2020. For more information, please see our Active Ownership Report.

Enhanced sustainability standards promoted through investment restrictions

During the past year, Danske Bank Asset Management has expanded its investment restrictions from 326 companies in 2020 to 786 companies in 2021.

By promoting enhanced sustainability standards, Danske Bank Asset Management commit to exclude companies and countries that are involved in activities leading to significant principal adverse impacts on sustainability factors. They exclude companies that otherwise express weak sustainability practices and they exclude companies that do not have minimum social safeguards, or fail the “Do No Significant Harm”-test.

Danske Bank Asset Management has for instance restricted 18 companies involved in deforestation. These companies were primarily linked to the clearing of tropical rainforests in Brazil (Amazon) and in Malaysia, Indonesia and Borneo. Read more about our restriction of companies involved in deforestation on page 43 in the report.

Disclaimer:

The statements in this article is neither investment advice nor an offer or solicitation of any

offer to purchase or sell any financial instrument. Always be aware that investment involves risk and that

historical performance information is not indicative of future performance or investment returns, which can be

negative. Please consult with your professional advisors about the legal, tax, financial or other matters

relevant to the suitability and appropriateness of an investment.