Private equity funds take up an increasing share of the financial landscape, acquiring companies with funds raised from various types of investors, primarily institutional investors. Their strategy is often to optimise a company’s capital structure, extract synergies, act as industry consolidator or invest in developing the company.

”As an active and responsible investor, we put pressure on the private equity fund as part of safeguarding our customers’ investments.”, says Cecilie Hoffmeyer, senior portfolio manager, Danske Bank

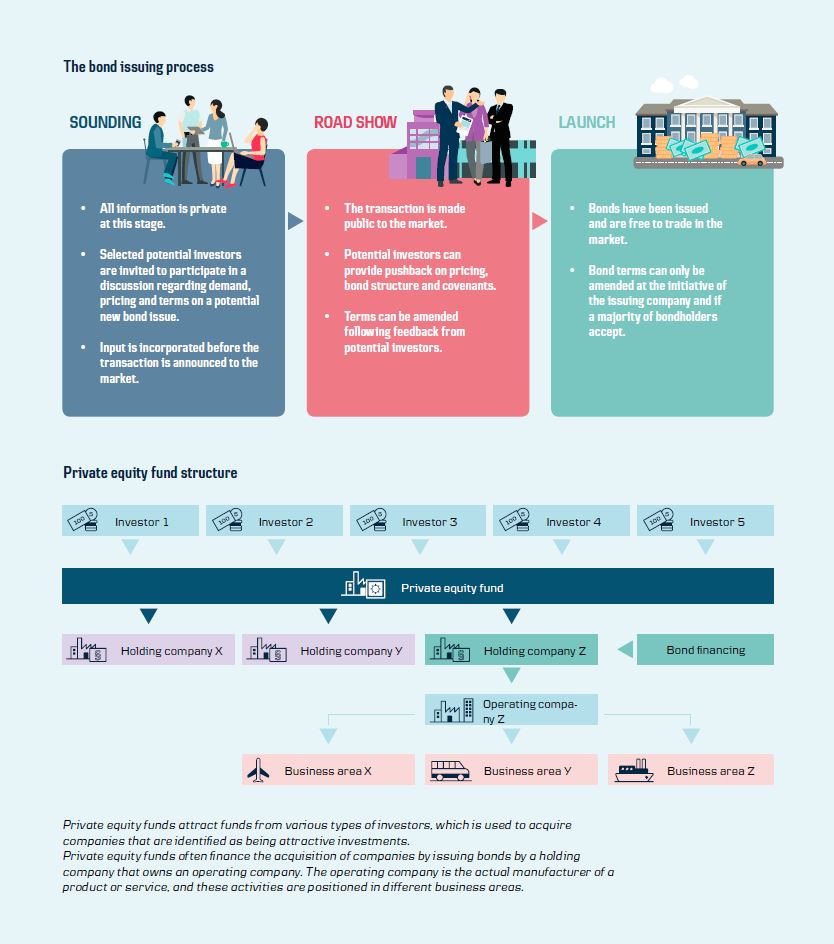

The acquisition and execution of the private equity fund’s new strategy is partly financed by incurring debt. One financing option for private equity funds is to issue corporate bonds. Danske Bank’s corporate bond team regularly invests in this type of corporate bonds and so in effect lends money against receiving an interest rate that reflects the risks related to the investment. Significant negative consequences can arise for the investment if the terms and conditions of the bond are not clearly stipulated and, for example, fail to address issues such as how proceeds from divestment of business areas should be utilized.

Cecilie Hoffmeyer is Senior Portfolio Manager in Danske Bank’s corporate bond team, and she and her colleagues put spotlight on this as part of their active ownership. “We see favourable return possibilities in corporate bonds, but before investing we evaluate the terms and conditions thoroughly alongside legal experts, as specific wording can be critically important. Private equity funds often seek to have maximum flexibility in the bond terms, in order for them to, for example, extract proceeds when they divest certain business areas of the acquired companies and pay an extraordinary dividend to their investors. These potential terms are of great significance for us as bond investors,” says Cecilie Hoffmeyer.

A bond’s terms are a key part of the analysis conducted by the corporate bond team along with the strategy and financial position of the acquired company. The purpose is to ensure that the company is capable of making the regular interest payments and repay the bond principal to Danske Bank and other investors.

Protecting the investment

During the period of private equity ownership, the fund can sell business areas that do not fit into the strategy and pay out proceeds to investors. This is one of the ways private equity funds can create returns before they, typically after five to seven years of ownership, for example, list the company on a stock exchange, or sell it to another private equity fund or industry player.

When Cecilie Hoffmeyer and the bond team assess whether a corporate bond is attractive or not, the company’s current and expected future earnings, cash flow, assets and debt are analysed. If the private equity fund’s strategy is to divest business areas, the team carefully examines the potential impact on the company’s ability to make interest payments on the bonds and to repay the bond debt. The rationale is that extracting money from the acquired company through divestment of business areas should not be an option. Instead, the proceeds should remain in the company and be used, for example, to repay debt or to invest in growth e.g. by investing in new product areas or expanding into new markets.

Together with her colleagues in the corporate bond team, Cecilie Hoffmeyer engage in dialogue with private equity funds, their banks and the acquired companies when the bond terms do not provide sufficient assurance that proceeds will remain in the company if e.g. specific business areas are sold.

” We see favourable return possibilities in corporate bonds, but before investing we evaluate the terms and conditions thoroughly alongside legal experts, as specific wording can be critically important. Private equity funds often seek to have maximum flexibility in the bond terms, in order for them to, for example, extract proceeds when they divest certain business areas of the acquired companies and pay an extraordinary dividend to their investors. These potential terms are of great significance for us as bond investors” Cecilie Hoffmeyer, Danske Bank

Market position enables the ability to influence

Due to Danske Bank’s position in the Nordic bond market, Cecilie Hoffmeyer and the team have the ability to influence private equity funds in some cases and amend bond terms before they are offered to the financial market. They are often invited to provide input to e.g. pricing of the bond or bond terms before the bond is announced to the market, while in other cases they take part in influencing bond terms after the announcement of the issuance.

For example, the team was interested in investing in a sizeable corporate bond issued by a Nordic company, but the new private equity owner strongly indicated that they would divest specific business areas shortly after the bond was issued.

“As an active and responsible investor, we put pressure on the private equity fund as part of safeguarding our customers’ investments. Because we are an investor of significant size in the Nordic market, we were in a good position to amend the bond terms – which helps protect the financial stability of the company and our investment. Our message was very simple; they had to close the loophole, otherwise we were not interested in investing,” explains Cecilie Hoffmeyer.

Other investors echoed that messaged, and following negotiations and dialogue with Danske Bank’s corporate bond team and other interested investors, the terms were eventually amended in order to avoid a situation where capital could be extracted from the company should business areas be sold.

This is a typical example of how Danske Bank’s corporate bond team is impacting private equity funds to inhibit them from extracting value from companies. It is of great importance, as it can fundamentally alter debt and earnings levels. It helps prevent the company’s financial situation from being weakened by having too large a debt relative to earnings levels and the value of its assets. Instead, the private equity fund should allocate the proceeds from divestments to reduce debt or to invest in developing and strengthening the company’s business profile.

Read more about our work with active ownership and ESG-inside.