Key takeaways

• Core inflation measures continue to strengthen globally.• It will be fairly easy for central banks to bring inflation back to target, but this will be slow and uneven.

• Inflation-linked bonds can help protect your portfolio from inflation risks.

Global inflation remains stubbornly high, even as global central banks continue to raise key policy rates by unprecedented speed and size compared to the last 3 decades whilst also signalling that policy rates will have to remain higher for longer. This is due to inflation becoming stickier, broad based, increasingly domestically driven and volatile.

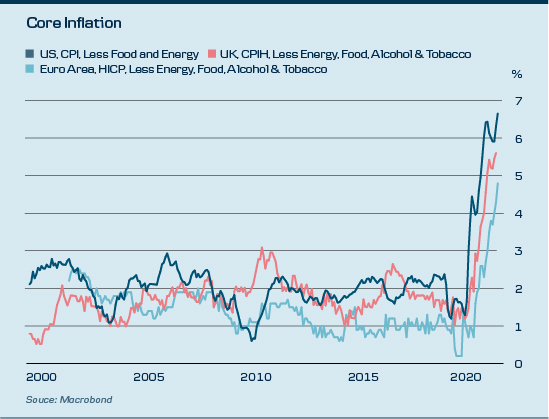

Core (underlying trend) inflation measures continue to strengthen globally. Trimmed mean and median inflation measures in Europe and the US are now well above levels seen over the last 2 decades, which is signalling that the components least impacted by pandemic related issues (bottlenecks) and Russia’s invasion are experiencing strong inflation. Our core measure for the US (headline US CPI ex volatile components) is printing at 0,69% (SA, MoM) for September, which is 8,6% annualised, and is above other commonly published core inflation figures.

READ ALSO: 5 key questions and answers about hedging inflation in a portfolio

Core services inflation continues to print strongly

Looking deeper, core services inflation, particularly within the more persistent and sticky shelter components, are continuing their recent strength. Owners’ equivalent rent of primary residence and rent of primary residence, which make up approximately 30% of headline inflation, in September printed at 0.80% and 0.88% (NSA, MoM) respectively, and there is a risk that these two large components remain higher for longer.

This is leading to inflation remaining stubbornly higher than previously expected by central banks.

The US Federal Reserve’s own Summary of Economic Projections also support the view that inflation is becoming stickier and broad based. September projections for core PCE inflation were revised higher by 0.2% for 2022 and 0.4% in 2023, and with core PCE inflation expected to remain above the 2% target in 2025.

Sustained wages strength and persistent inflation mirrors the stagflationary environment of the 1970’s ...Matthew Wells, portfolio manager.Food and energy impacted by climate and geopolitics

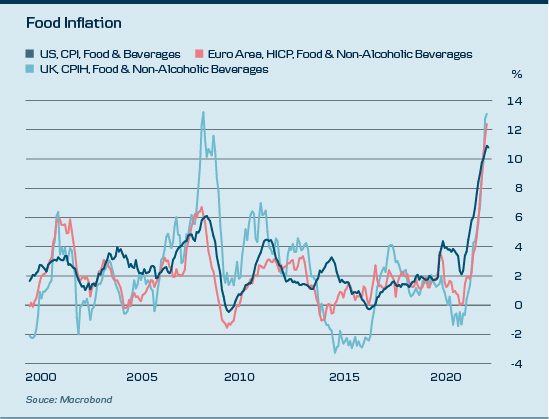

In addition to this, volatile inflation components such as food and energy are being impacted by climate and geopolitical events, leading to more volatile inflation, and contributing to higher inflation persistence.

Regarding food, droughts across the US, China, India and Europe alongside recurrent La Nina conditions are affecting crop yields, and combined with higher fertiliser prices, are driving agricultural commodity prices higher.

Russia’s invasion of Ukraine continues to drive volatility across global energy markets, particularly as Nord Stream 1 gas supplies ceased and Europe rushes to import LNG and coal through spot markets. Energy futures curves are now pricing that energy prices will remain higher for longer, leading to higher and more volatile household energy and transportation costs.

Mirrors the stagflationary environment of the 1970’s

Whilst governments, via unfunded fiscal policies, have moved to protect households and businesses via subsidies, reduced VAT, tax cuts and household payments, many of these policies do not target a reduction in household demand. Rather they are keeping demand at current levels, which is not helping to alleviate inflation pressure. In many ways, this is a repeat of the loose fiscal policies adopted during Covid-19 that backfired and led to the excessive demand and inflationary pressure that central banks are currently trying to fight.

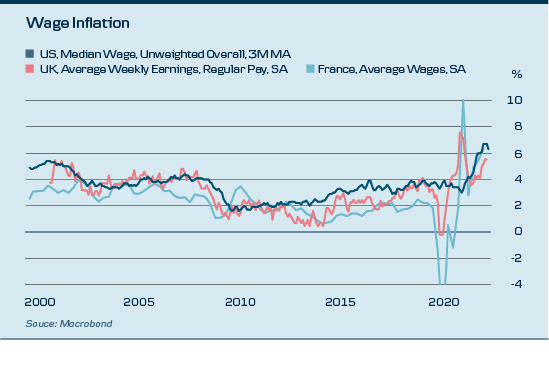

Combined, this has put significant pressure on labour markets, which are extremely tight in many advanced economies, and had led to sustained and significant increases in wages. Sustained wages strength and persistent inflation mirrors the stagflationary environment of the 1970’s, where the ‘wage-inflation loop’ was a dominant feature of the ‘The Great Inflation’ of the 70’s and 80’s. During this period, higher inflation drove higher inflation expectations, which drove higher wages and thus higher inflation again. Avoiding this vicious loop is of the upmost importance for central banks, and hence why core inflation and wages measures are being closely watched.

Inflation protection more important than ever

To conclude these thoughts, we think it will be fairly easy for central banks to bring inflation back to target, but we think this will be slow and uneven. However, there is a risk around this, as there is uncertainty around to what degree central banks will be willing to drive the economy into a hard enough recession in order to return inflation to target.

Due to this, protecting portfolios from inflation is now more important than ever, and inflation-linked bonds are an asset classes than can help protect your portfolio from such risks.

Please reach out to the Danske Bank Asset Management Inflation Strategies team for more information.

For further information on our Global Inflation Strategies, please contact the Head of Global Asset Management Sales, Nicolaj Holm-Christiansen at nicch@danskebank.dk, the Head of Global Inflation and Chief Portfolio Manager, Christian Østerbye Vejen at chve@danskebank.dk, or Global Inflation Portfolio Manager Matthew Wells at mwel@danskebank.dk.

This publication has been prepared as marketing communication and does not constitute investment advice. Note that historical return and forecasts on future developments are not a reliable indicator of future return, which may be negative. Always consult with professional advisors on legal, tax, financial and other matters that may be relevant to assessing the suitability and appropriateness of an investment.