Even though larger companies typically get the most attention, that is not always where investors get the highest returns. The European stock market clearly shows this.

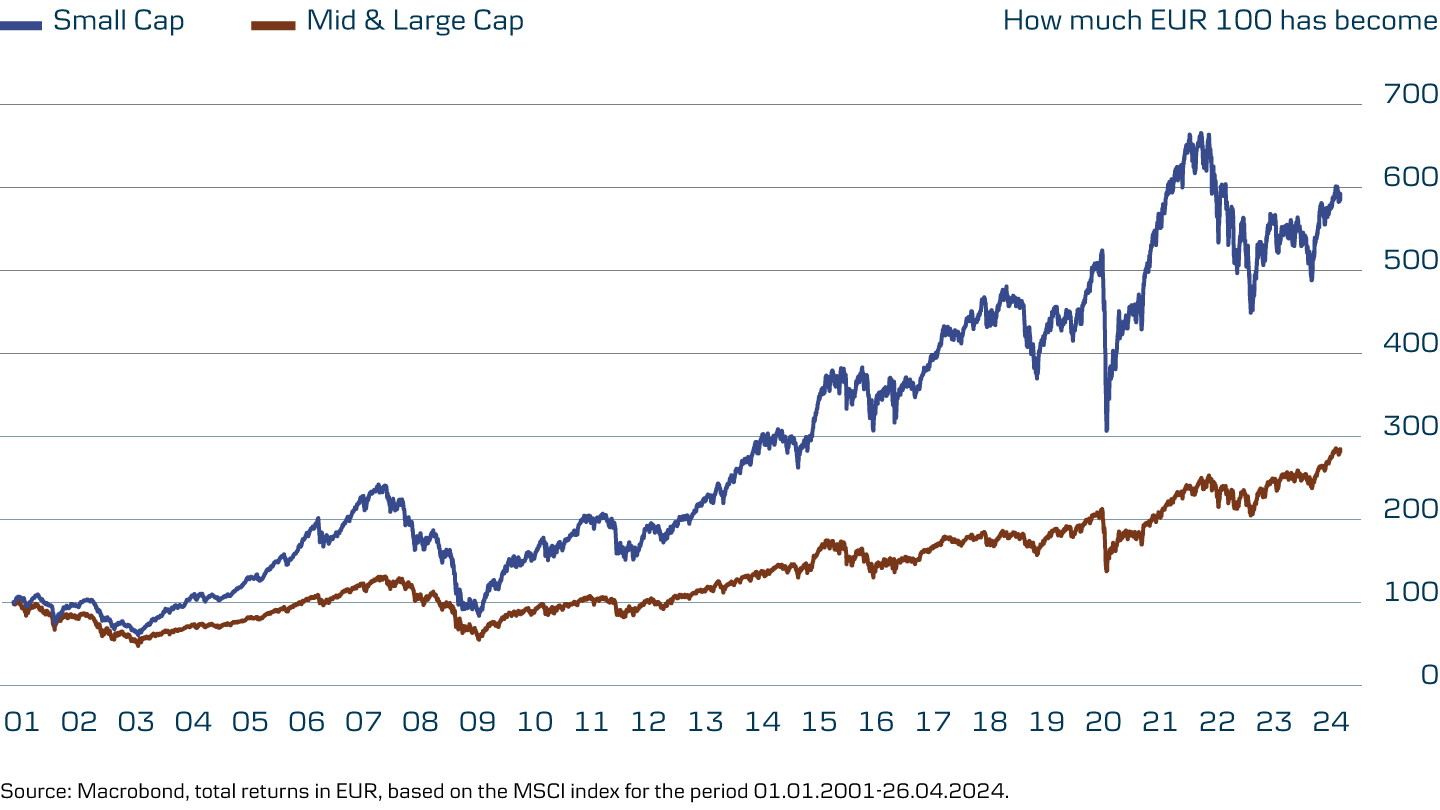

Since 2001, European small cap stocks have delivered a return of 492 pct., while the corresponding figure for European mid and large cap stocks is 184 pct. (see graph).

Small cap stocks are therefore an extremely attractive segment of the European equity market and also the focus of the fund Danske Invest Europa Small Cap, klasse DKK d, which for many years has invested in the asset class with considerable success.

In fact, the actively managed equity fund has just received a prestigious Lipper Fund Award for the best risk-adjusted return over 10 years among 40 different Nordic-based funds concentrating on European small and mid cap stocks.

For the skilled and thorough investor, the small cap segment offers good opportunities to identify overlooked gems in the stock market.Christian Rasmussen, Chief Portfolio Manager.

Focused companies in attractive niches

But why have European small cap stocks yielded a significantly higher return than larger European companies? According to Christian Rasmussen, chief portfolio manager for Danske Invest Europa Small Cap, there can be several reasons:

"Small cap companies are often highly focused. While many large companies have activities in various segments of their industry, smaller companies often have a sharper focus. Naturally, this can increase risk, but if the company operates in a growth area, it can offer a good opportunity to grow with the market," he says and continues:

"At the same time, there can be attractive niches within small cap companies where the number of competitors is limited, so well-run companies have good opportunities to gain market shares and grow bigger."

Small cap stocks have provided the highest return

Historically, European small cap stocks have yielded significantly higher returns than larger European stocks (mid and large cap). However, historical returns are not a reliable indicator of future returns, and returns can also be negative.

Opportunity to find overlooked gems

Christian Rasmussen manages investments in the fund alongside senior portfolio manager Alexander Zola, and they have both worked with the investment strategy since 2015. During this period, the fund has delivered a solid excess return compared to its benchmark (see graph).

According to the chief portfolio manager, European small cap stocks are both attractive and challenging at the same time:

"Smaller companies are often neglected by analysts, who make more effort to analyse the large companies, as understanding individual small cap companies often requires more legwork. However, the rewards can be huge if we manage to select the right companies for the portfolio. For the skilled and thorough investor, the small cap segment offers good opportunities to identify overlooked gems in the stock market," he says.

Particular focus on companies in "the sweet spot"

Danske Invest Europa Small Cap has about 60 different companies in its portfolio. The investment ideas are derived partially from data-intensive market screening and partially from networking and company meetings. Or "feet on the street," as Christian Rasmussen puts it.

Even though the fund can invest in companies with a market value of up to EUR 5 billion, the portfolio managers have a particular focus on companies with a market value of between EUR 0.5 and 1.5 billion.

"We view that as the sweet spot. Such companies are typically big enough to have a reasonable foundation, as they have shown that their business works. But at the same time, they often fly a bit under the radar due to low coverage by stock analysts, plus they usually have no investor relations department and rarely participate in investor conferences," says Christian Rasmussen.

In recent years, European small cap stocks have significantly lagged larger European stocks. Since the beginning of 2022, the return from small cap stocks has been almost 25 percentage points lower than the return from mid and large cap stocks.

This has resulted in European small cap stocks currently being priced cheaper than mid and large cap, as measured by P/E (12m forward) ratios. Historically, this is unusual. Additionally, European small cap stocks are also priced cheaply right now compared to their own historical average.

Small cap stocks are typically more cyclical than large cap stocks — meaning they are more affected by economic conditions. They usually perform best during an economic expansion, and after a very sluggish 2023 for the European economy, there are now faint signs of a growth pickup in Europe. Furthermore, small cap stocks generally have greater exposure to their home markets, so higher growth in Europe could also provide an extra tailwind for European small caps.

Share price grew more than tenfold

Paradoxically, the dream scenario is to identify companies capable of growing so much that they no longer belong in the fund's investment universe – the future champions of the European equity market, or as the chief portfolio manager puts it:

"Even the world's largest companies were small once".

As an example, he mentions a Swedish industrial company that the fund invested in 10 years ago – a so-called serial acquirer that regularly bought up other companies within the industrial sector. In 2021, the stock was sold out of the portfolio again after the share price had increased more than tenfold and the company had grown out of the small cap universe.

The companies may not have large investor relations departments but, on the other hand, we have the mobile numbers of most of the CEOs of our investee companies. Alexander Zola, Senior Portfolio Manager.

Contact list includes most CEOs

The portfolio team focuses on finding companies enjoying structural tailwinds and of high quality – and which they assess can do well in five years' time.

"At the moment, for example, we have a large overweight of companies within software and medtech, which we believe encompass many exciting companies that are attractively priced. We generally follow a bottom-up approach, focusing on interesting long-term investment cases – we do not compose our portfolio based on short-term fluctuations in the macro economy. The hunt for good long-term investment cases is deeply ingrained in the fund's DNA," says senior portfolio manager Alexander Zola.

One advantage of investing in smaller companies is that the portfolio team has better access to the companies' top management.

"The companies may not have large investor relations departments but, on the other hand, we have the mobile numbers of most of the CEOs of our investee companies. We have a level of access that is rarely the case with large companies," explains Alexander Zola.

Be aware of the risk

Despite the portfolio managers' thorough and selective stock picking and strong focus on diversification, there are always significant risks associated with investing in stocks, including overall market risk and company-specific risks related to the development of individual companies in the portfolio.

Furthermore, you should also be aware that small cap stocks are usually less liquid than large companies, which can result in more pronounced price fluctuations than for the equity market in general during certain periods.

The fund has beaten its benchmark

Danske Invest Europa Small Cap, klasse DKK d, has achieved a higher accumulated return than its benchmark over the past 10 years, calculated after ongoing administration costs in the fund. However, historical returns are not a reliable indicator of future returns, and returns can also be negative.

Photo: Odd Andersen/AFP/Ritzau Scanpix.

This publication has been prepared as marketing communication and does not constitute investment advice. Please consult with your professional advisors about the legal, tax, financial and other matters relevant to the suitability and appropriateness of an investment to ensure that you understand its risks. Please refer to the prospectus and the Key Information Document before making any final investment decision. A summary of investor rights as well as more information on the sustainability aspects of the fund can be obtained in Danish here. The decision to invest in the fund should take into account all of the environmental and/or social characteristics of the fund as described in the prospectus. Danske Invest Management A/S may decide to terminate the arrangements made for the marketing of its funds.