When it comes to sustainability, focus is often mostly on a company’s products and less on how the company makes those products – but what is the point of producing environmentally friendly electric cars, for example, if the manufacturing process is extremely detrimental for the environment and employees?

At Danske Bank, we have therefore developed our own internal analytical tool – mSDG – that includes both a company’s products and its operations in our assessment of the company’s sustainability profile. With mSDG, we focus not only on what a company produces, but also on how the company produces it.

“Our mSDG tool allows us to systematically assess the extent to which a company contributes positively to the UN’s 17 Sustainable Development Goals,” explains Camilla Adamsen Nielsen, portfolio manager in the credit team at Danske Bank Asset Management.

Today, mSDG is an important tool for our credit investment teams when analysing and selecting corporate bonds.

This way, we can support and reward companies that are on a positive development track Camilla Adamsen Nielsen, portfolio manager at Danske Bank Asset Management.

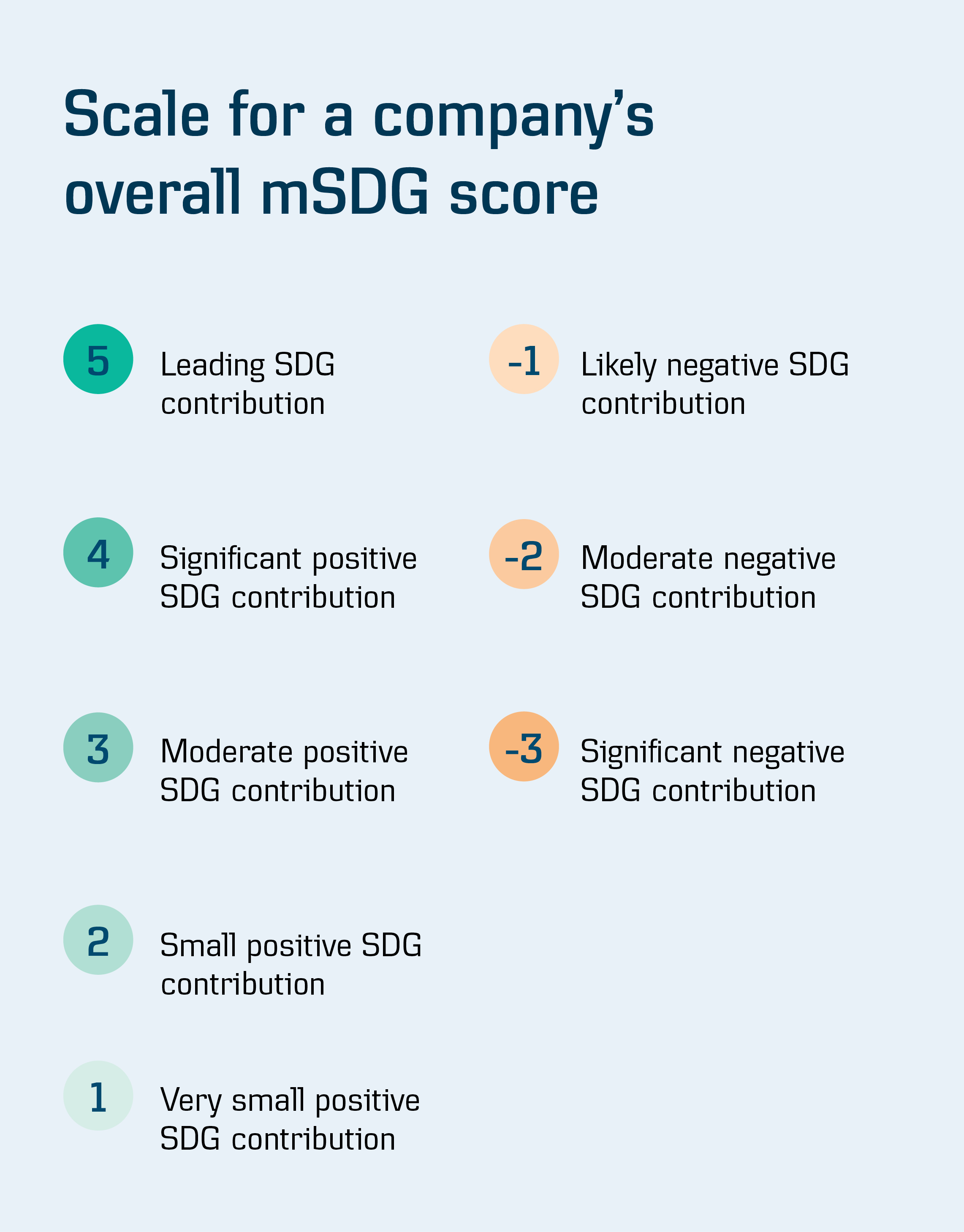

• Our proprietary analytical tool, mSDG, assigns companies a score from -3 to 5 in relation to how well the companies contribute to fulfilling the 17 UN SDGs.

• mSDG is an integral part of our sustainable investment house view model and utilises data from the external suppliers MSCI, Util, Sustainalytics, TruValuelabs and ISS.

• Companies are assigned a score both for how their products or services contribute to fulfilling the SDGs and also for how their operations – in other words, the production of these products or services – contribute to fulfilling the goals. This gives a total overall mSDG score.

• A company’s mSDG score is based on a combination of the company’s absolute contribution to the UN SDGs and its relative contribution – in other words, its contribution relative to the other companies in its sector. Thus, a company will also be rewarded if it contributes positively to the transition towards increased sustainability within its sector.

• mSDG supplements our other proprietary analytical tool, mDASH, which identifies which risks are associated with the company’s handling of sustainability issues.

We consider the entire value chain

With mSDG, each and every company is assigned a score for how its products or services contribute to the UN SDGs and also a score for how its operations contribute to the SDGs – whether positive or negative. A company’s operations often contribute negatively due to its consumption of various resources, such as raw materials or energy.

The two scores are combined to produce an overall result for the company’s contribution to the SDGs.

“This ensures that no companies get a free pass in relation to sustainability just because they make products that contribute to sustainable development. With mSDG, we consider the entire value chain – and what is important for us is that companies both measure and have a strategy for how they can minimise the negative impact on the SDGs from their operations while at the same time optimising the positive impact of their products and services,” says Camilla Adamsen Nielsen.

The overall score ranges on a scale from -3 to 5, with the highest score reserved for “Leading SDG contribution” (see chart below). In our Global Corporate Sustainable Bond strategy, this is the case for US company Xylem. The company scores 5 on our scale and is thus a leading SDG contributor, mainly SDG no. 6 – clean water and sanitation.

How mSDG is used in practice

Camilla Adamsen Nielsen says that what she and the rest of the investment team normally would look for is an overall score of at least 1.

“A score of 1 means a company makes a very small positive contribution to the UN SDGs. However, bonds issued by companies with an mSDG score of less than 1 may also be included in the portfolio if our qualitative evaluation of the company shows, for example, that it has a clear strategy for reducing its negative impact on the SDGs, or it has a positive impact on a specific SDG that our mSDG tool does not capture. This way, we can support and reward companies that are on a positive development track,” explains Camilla Adamsen Nielsen.

One example she mentions is the German company Volkswagen, which is included in the European Corporate Sustainable Bond strategy. Volkswagen currently has an mSDG score of -1, but it plays a significant role in the transition from vehicles with internal combustion engines to electric-powered vehicles and has a target of 50 per cent of the vehicles it sells being electric by 2030.

“This transition has a positive impact on SDG number 13 – climate action,” says Camilla Adamsen Nielsen.

A positive side effect

However, a company’s mSDG score is never the sole foundation for the portfolio manager’s decision on which investments to select – it is merely a single piece in a bigger jigsaw puzzle. Other important factors include a thorough analysis of the business, strategy, credit quality and capital structure of the individual companies.

A company’s mSDG score also has a positive side effect.

“It provides a good starting point for a constructive dialogue with companies about how they can improve in terms of sustainability,” concludes Camilla Adamsen Nielsen.

If you want to know more

The contents of this article is part of our 2022 Responsible Investment Journey report about our work with active ownership and other topics within our sustainability work: From how we concretely incorporate sustainability considerations into our investments to our screening and restriction policies and our reporting. You can find the report here.This publication has been prepared as marketing communication and does not constitute investment advice. Note that historical return and forecasts on future developments are not a reliable indicator of future return, which may be negative. Always consult with professional advisors on legal, tax, financial and other matters that may be relevant to assessing the suitability and appropriateness of an investment.