Global Portfolio Solution is the latest generation of portfolio management solutions for institutional customers, and after a challenging 2022 due to steeply rising interest rates, they bounced back strongly in 2023, with all portfolios generating solid returns – in both absolute terms and relative to their reference indexes.

“All portfolios in our Global Portfolio Solution produced higher returns than their reference indexes in 2023, which we are very happy about on behalf of our customers,” says Thomas Otbo, CIO in Danske Bank Asset Management.

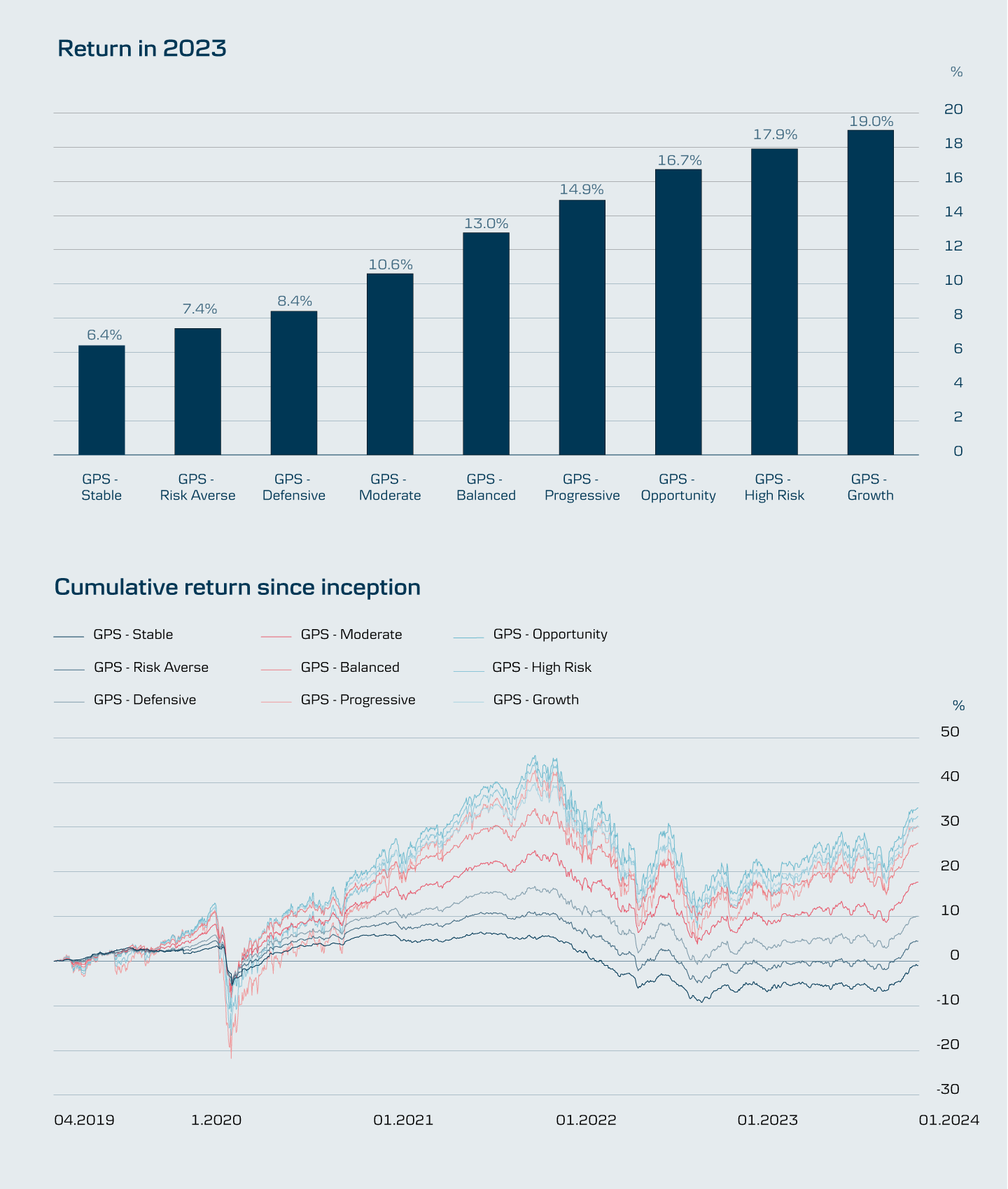

Absolute returns for 2023 came in at between 6.4% and 19.0%, depending on the level of risk. Return data have been calculated after fund costs but before agreement fees.

Another boost came from our quant strategies, where we apply advanced algorithms to screen the market for the best equities. Søren Funch Adamsen, Head of Portfolio Construction at Danske Bank Asset Management.

Additional tailwinds

Both equities and bonds generally had a good year in 2023, but several factors also produced additional tailwinds for Global Portfolio Solution – including our tactical allocation having a higher share of equities than we expect to have in the longer term.

“Another boost came from our quant strategies, where we apply advanced algorithms to screen the market for the best equities based on selected criteria, such as company valuation, growth and price momentum,” explains Søren Funch Adamsen, who is Head of Portfolio Construction at Danske Bank Asset Management.

Extra boost from hedge funds

Finally, the alternative investments in the portfolios contributed to lifting performance, with not least our hedge funds standing out after having one of their best years ever.

“Our fixed income hedge funds in particular produced impressive returns in 2023 and thus helped boost overall return in the portfolios,” says Søren Funch Adamsen.

Return for the various risk profiles in Global Portfolio Solution. Note that historical return is not a reliable indicator of future return, and return can also be negative. There is always a risk of loss associated with investing.

Source: Danske Bank. Return calculated after all fund costs but before agreement fees.

This material has been prepared for information purposes only and does not constitute investment advice. Note that historical return and forecasts on future developments are not a reliable indicator of future return, which may be negative. Always consult with professional advisors on legal, tax, financial and other matters that may be relevant to assessing the suitability and appropriateness of an investment.