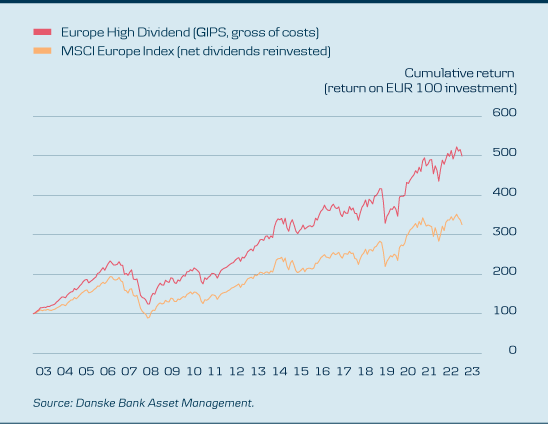

20 years since the inception of our Europe High Dividend equity strategy. Six Morningstar awards for best European equity fund in Denmark for Danske Invest funds based on the strategy. An armful of awards outside Denmark too. Average annual outperformance for the strategy of 2.3% vs. MSCI Europe (GIPS, see chart). More than EUR 2bn in AuM as of November 2023.

And the portfolio managers who have been part of the whole journey – Chief Portfolio Manager Peter Nielsen and Senior Portfolio Manager Asger Lund Nielsen – are still going strong.

“At Danske Bank Asset Management, we value quality and stability, and Peter and Asger are living proof of that. Our Europe High Dividend strategy benefits greatly from their many years of experience in selecting dividend stocks,” says Danske Bank Asset Management CIO Thomas Otbo.

We have a slightly contrarian approach, being on the lookout for perhaps less popular ideas in the equity market rather than buying what everyone else is buying. Peter Nielsen and Asger Lund Nielsen, portfolio managers at Danske Bank Asset Management

Guiding rules and principles

Peter Nielsen and Asger Lund Nielsen focus on companies deemed capable of paying high dividends year after year. Companies that are often characterised by stable business models with predictable earnings and stable cash flows.

Throughout the 20 years, the portfolio managers have based their stock selection on a series of guiding rules and principles. Here they share some of them here:

✓ We prefer to invest in more mature companies rather than newer businesses that do not have much of a track record.

✓ Understanding a company’s capital requirements is important for determining whether their dividend levels are sustainable over the long term.

✓ Most investors look for high rates of growth, but our experience is that dividends are generally more predictable than long-term growth rates.

✓ We have a slightly contrarian approach, being on the lookout for perhaps less popular ideas in the equity market rather than buying what everyone else is buying.

✓ Our contrarian approach applies to both buying and selling – cash-in profits when prices are high and everything is going well, but also remember to buy additional stock when a company faces a short-term challenge and prices are low.

✓ We know the companies we have invested in better than those we have not invested in – so there should not be too many new stocks constantly entering the portfolio. That is too risky.

✓ Be disciplined about buying and selling – don't get carried away. We use our quantitative model to guide us and maintain discipline.

✓ We are focused on diversification both across sectors and within individual sectors.”

Two decades with a strong track record

Cumulative return since inception of our Europe High Dividend strategy. Strategy benchmark is MSCI Europe. Average annual return (GIPS) for the strategy has been 8.4%, compared to 6.1% for MSCI Europe. Past performance is not a reliable indicator of future results. Future returns may be negative.

Why financials has been our preferred sector

Financials has always been the largest sector in the strategy – Peter Nielsen explains why:

“Financial sector valuations are low relative to the market and the sector typically generates good cash flows and solid dividends. In recent years, we have tended to overweight insurance companies, as they are less cyclical than banks. Moreover, earnings from insurance have generally become more stable and the business more profitable over the years. The years with a low-yield environment made it difficult for insurance companies to achieve good investment returns from bond markets, and that forced companies to become more disciplined in terms of pricing and risk tolerance in their insurance dealings.”

Risks associated with the strategy

While equities with high and stable dividend payments are often less volatile price-wise than the equity market in general, an investment in the Europe High Dividend strategy nevertheless entails a significant risk. Dividend stocks can experience significant losses during equity market downturns, and the strategy’s return also depends on the portfolio team’s ability to stock pick attractive equities for the portfolio.

Another significant risk factor is the macroeconomic climate in Europe, as low or negative growth here can have an adverse impact on the equity market, just as high interest rates can make stocks relatively less desirable.