Chief Portfolio Manager Søren Mørch and his team have been managing our Emerging Markets Debt Hard Currency strategy since 1 November last year – and in their first six months they have outperformed the benchmark by 1.99 percentage points, as calculated net of fees for the Danske Invest SICAV Emerging Markets Debt Hard Currency Class I fund.

We have significantly increased our exposure to ESG-labelled bonds, taking advantage of fundamentally compelling opportunities ... Søren Mørch, Chief Portfolio Manager.

What drove the outperformance of the past six months?

“Our overweights in Mongolia and Romania were major contributors to our outperformance, with both countries delivering solid returns. El Salvador, despite our overweight being rather modest, also made a positive contribution on the back of a stunning 57% return over the past six months. Underweighting AA, A and BBB-rated countries while at the same time overweighting lower-rated countries also proved a profitable strategy,” says Søren Mørch.

What have been your biggest adjustments to the portfolio since taking over?

“One of the biggest adjustments has been to lower our exposure to African bonds. In contrast, we upped our exposure to European bonds, which proved a sound move, as Africa delivered the lowest return of all regions in the past six months, while Europe delivered the highest.

Europe – and Eastern Europe in particular – is benefitting from lower gas prices and the war in Ukraine not spilling over into other countries. Africa, on the other hand, faces numerous structural challenges. So, these were the main reasons for our allocation changes.

We have also significantly increased our exposure to ESG-labelled bonds, taking advantage of fundamentally compelling opportunities in a segment of the EMD HC universe that continues to grow rapidly. There are numerous examples of emerging market sovereign issuers that have been particularly innovative in this space, including Benin, Chile and Uruguay."

Where do you see the most attractive return potential within EMD HC right now?

“We currently have a strong focus on B and BB tranches, where our exposure is highest in both absolute terms and relative to our benchmark.

Uzbekistan (rated BB+) is a good example. The country has substantial currency reserves and plentiful natural resources. Moreover, Uzbekistan is starting to turn away from Russia and to align more closely with the West, which we consider positive news."

Backdrop to EMD HC has turned much more supportive this year

Like other asset classes, EMD HC experienced a difficult 2022, suffering one of its largest drawdowns since the 2008 global financial crisis. However, returns have turned positive this year, anchored by more attractive valuations and an improving global macroeconomic outlook.“With global inflation on a decelerating trend, major central banks at or near the end of their hiking cycles, the Chinese economy re-opening post Covid and global growth still robust, the outlook for the asset class should remain supportive throughout the remainder of 2023,” says Chief Portfolio Manager Søren Mørch.

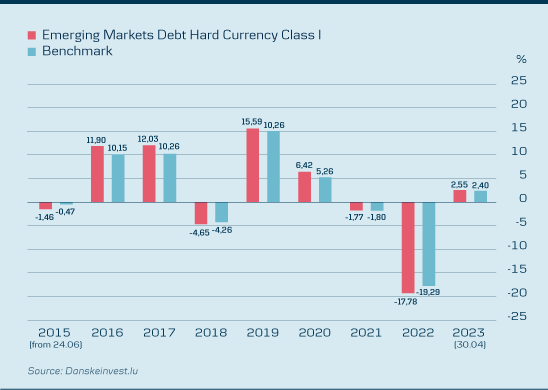

So far this year, Danske Invest Emerging Markets Debt Hard Currency Class I has delivered a positive return of 2.55% (as of 30.04.2023).

Annual returns

Annual returns since inception of Danske Invest Emerging Markets Debt Hard Currency Class I. Past performance is not a reliable indicator of future results. Future returns may be negative.

Any major risks in the EMD HC sphere in the near term?

“A hard global recession that reduces access to capital markets for the weakest emerging markets and which triggers a significant widening of credit spreads – that’s the biggest risk, in our view.

This scenario unfolding could potentially result in several countries needing to restructure their debt, for while debt restructuring has been avoided so far in 2023, countries like Pakistan, Tunisia, Egypt and Bolivia could be heading down that road.”

DISCLAIMER: This publication has been prepared as marketing communication and does not constitute investment advice. Please note that historical return and forecasts on future developments are not an indication of future return, which can be negative. Always consult with professional advisors on legal, tax, financial and other matters that may be relevant for assessing the suitability and appropriateness of an investment. Please refer to the prospectuses and the key investor information before making any final investment decision. The prospectuses, the key investor information of the fund and information regarding complaints handling (investor rights) can be obtained in English here (under “Documents”). Danske Invest Management A/S may decide to terminate the arrangements made for the marketing of its funds. More information on the sustainability-aspects of the funds can be obtained here. The decision to invest in the funds should take into account all of the characteristics of the funds as described in the prospectuses.