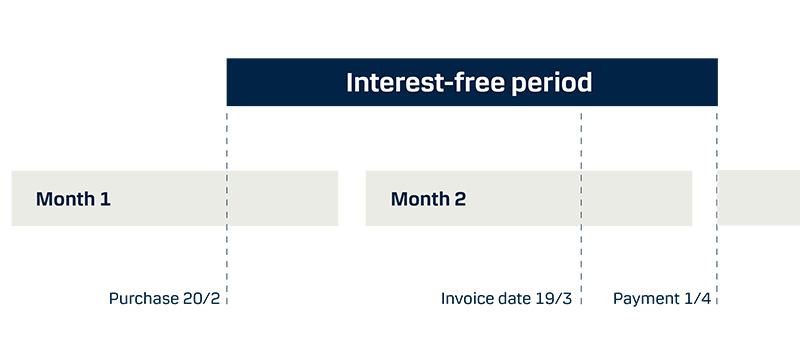

With the Mastercard Guld card, you choose whether you want to use the card as a debit card or a credit card. If you use it as a debit card, the amount is charged to your account immediately. If you instead use it as a credit card, you can defer payment for up to six weeks without having to pay interest.

To choose between debit and credit, you insert your card into the payment terminal and then select the appropriate button on the terminal. If you make a contactless payment, the card automatically functions as a debit card, and the money is therefore charged to your account immediately.