How to save up money in Danske Bank

Do you want to get the most out of your cash savings? On this site, you can see an overview of our various savings accounts to make it easy for you to find the account that suits you best – and give you the highest possible interest rate.

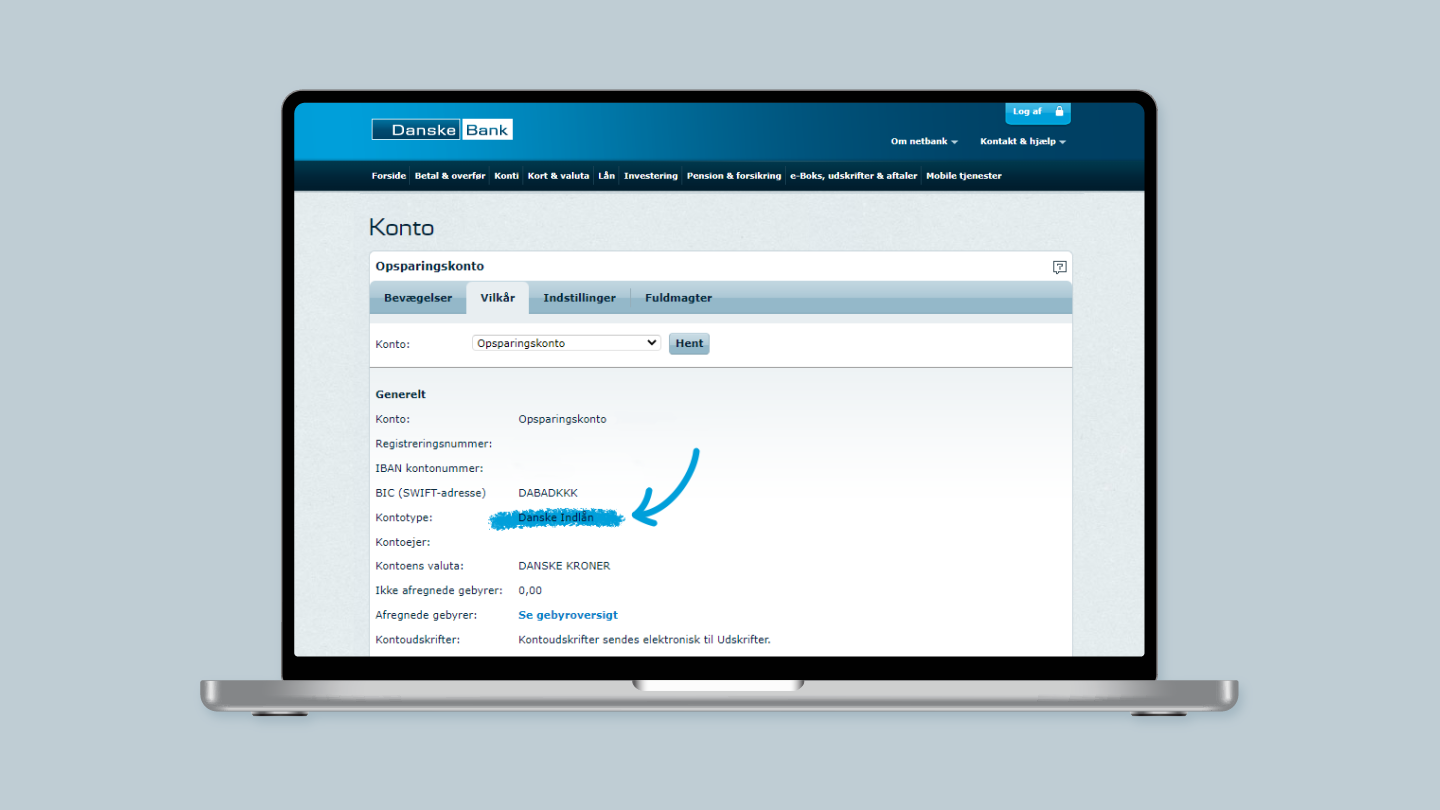

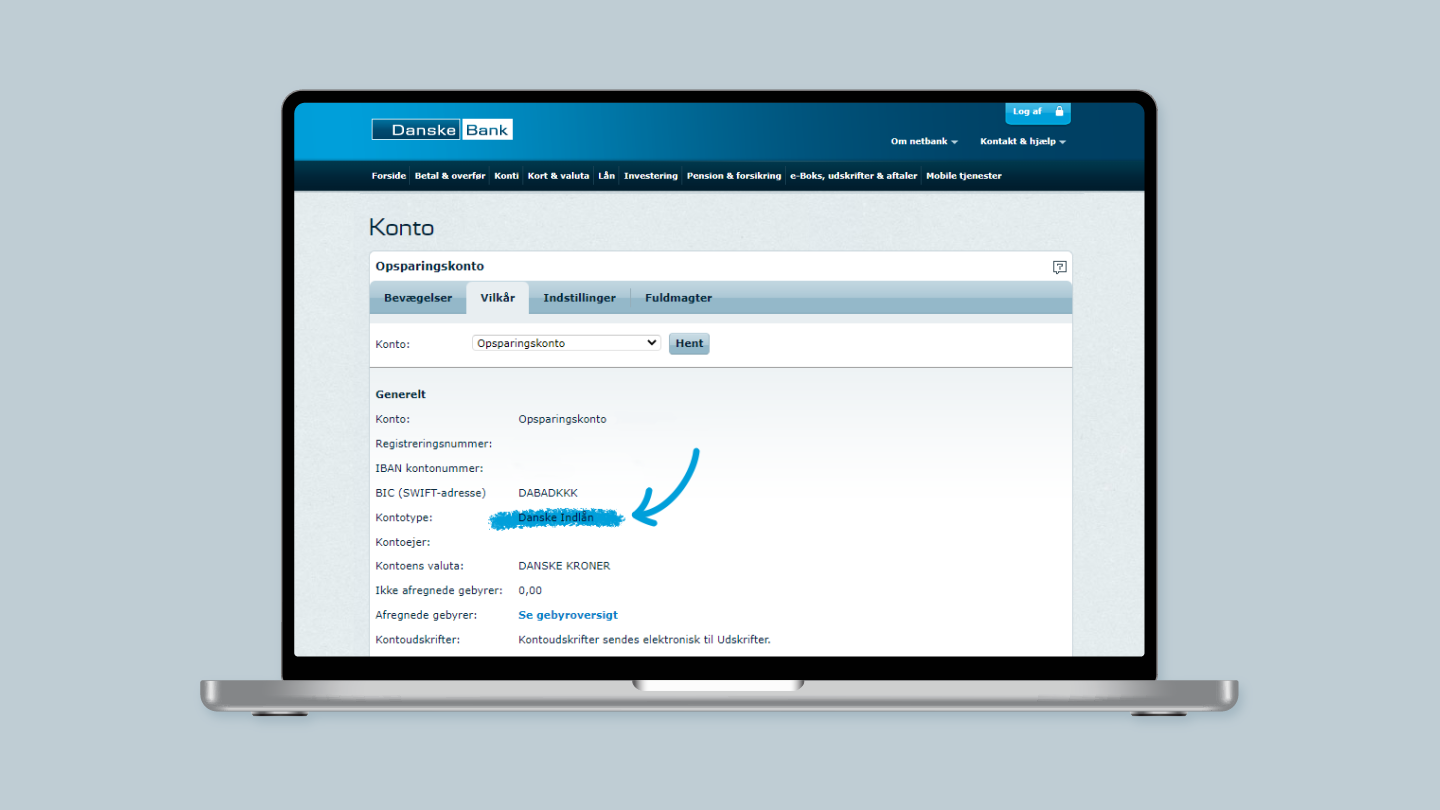

The Danske Indlån savings account

Danske Indlån is a simple and flexible savings account without a commitment period. It may be a good fit for you if you do not withdraw money from the account often. You can make free transfers to the account, and you can make withdrawals from the account once a month free of charge. If you need to make multiple withdrawals, you will be charged a fee per withdrawal. The interest rate is positive if you have your NemKonto account with Danske Bank. The interest rate is variable and depends on the balance of your account.

You can see the current interest rate for Danske Indlån here and read more about the terms here.

The Danske Toprente savings account

Danske Toprente is a savings account, where your savings are placed in a restricted access account for a fixed term in return for a favourable interest rate. It is a good fit for you, if you know that you will not need the savings for a period going forward. Your savings are tied up for 6, 12 or 24 months and you can deposit from 40,000 DKK and up to 25,000,000 DKK.

Read more about terms and interest rates and order the account here.

Child savings accounts and Danske Gave gift accounts

We have several savings accounts for children and young adults, where we offer favourable interest rates:

- The child savings account, Børneopsparing, can be set up for children aged 0-14 years. The funds must be tied for at least 7 years and cannot be paid out until the child reaches the age of 14. There are a number of other special terms that apply to the account, including who can open it and when it must be paid out.

Read more about the terms for Børneopsparing here. - Danske Gave is an account that you can open for children and young adults aged 0-25 years. The money on the account can be paid out when the account holder turns 18, 21 or 25 years.

Read more about the terms for Danske Gave here. - Min Drømmeopsparing is an account for young people between 13-17 years old who have saved up money or received money gifts which they would like to save and get a high interest rate on.

Read more about the terms for Min Drømmeopsparing here.

You can see the current interest rates for our child savings account here.

You do not need to have your NemKonto with us to obtain interest rates on Børneopsparing, Danske Gave and Min Drømmeopsparing.

Find the right investment

Do you have cash deposits, and would you like to learn more about investment options?

Do you need advice about your options?

You are always welcome to book a meeting with us if you want to discuss your options in relation to savings and/or investing.

Are you a Private Banking customer?

Special terms may apply for you as a Private Banking customer.